Market Outlook 2022

1.19.2022

False Alarm

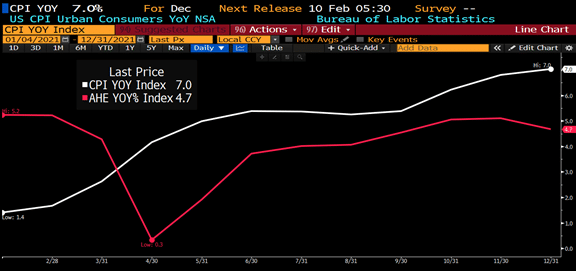

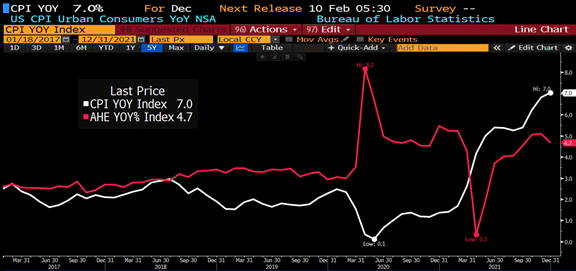

We believe the fed will not raise rates this year more than two times. It’s not necessary and it’s an election year. Our Reasoning is as follows: We believe raising rates 4 times or more will lead to an inverted yield curve. The current thinking is if prices go up, we have inflation. It’s not that simple. A more accurate reflection is if wages go up at a faster clip than prices, you have inflation. If prices go up faster than wages, you are headed for a recession. We believe the latter is the current state of affairs and the yield curve will reflect that if the Fed raises 4 times. (See chart below).

Prices (CPI) vs Wages (AHE) 1yr

Prices (CPI) vs Wages (AHE) 5yr

If the fed raises 50 bps, the curve flattens.

If the fed raises 100 bps, the curve is inverted.

We have a global arbitration towards zero on interest rates in developed countries due to soaring debt levels (U.S. at 1.40x GDP) and the US has joined the club in reckless spending. We suspect the 30-year goes to 1.50 reflecting a slowdown in growth due to pricing pressures and increased costs. Ultimately the fed will have to reverse course which puts the second half of 2022 in a better light but still rough sledding for most of 2022. For example, in 2021 the US spent $557 billion in interest debt. If the fed raises 100 bps, the interest debt would be approximately $800 billion annually.

2022 Winners:

Credit

China

Commodities

Leveraged Loans

2022 Losers:

Technology

Cryptocurrency