Unemployment, Fed, and The War

John Lekas – CEO & Portfolio Manger

July 29th, 2022

Three things are driving the market between now and 1/1/2023.

1. Unemployment (most important)

2. The Fed

3. The War & Policy

Unemployment (Most Important)

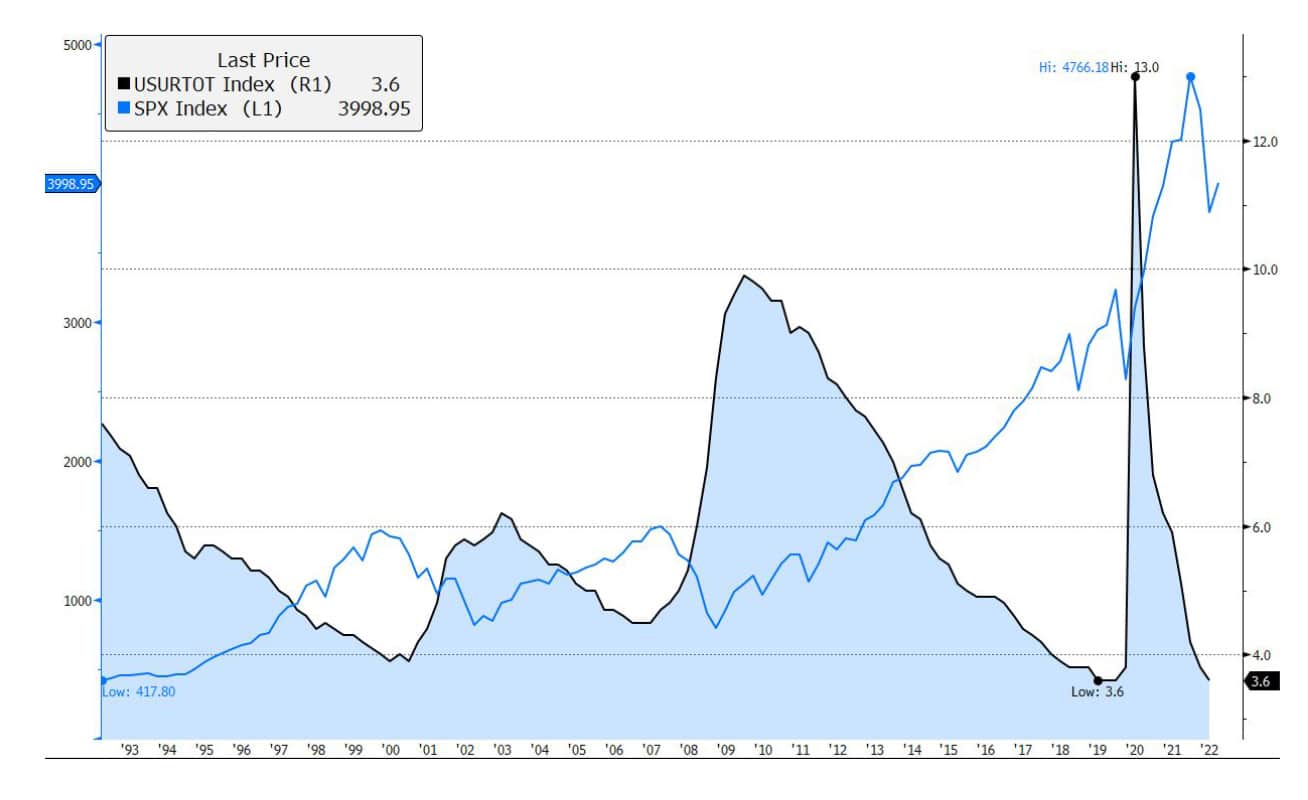

The negative correlation between unemployment and equity markets is quite high (-0.74%). The general belief is there are plenty of jobs, but no one wants to work. Some truth to that, the pandemic took away our sense of urgency in a lot of cases, particularly labor and jobs no one really wants. Inflation has zapped purchasing power. The real issue is small businesses (and large) have learned to get by on fewer people and many small businesses will not survive (See my trip to the store). The U3 unemployment will be the key for the remainder of 2022; if U3 climbs, markets will go lower. We see unemployment approaching 6% by year-end and as high as 10% by the second quarter of 2023.

U-3 Unemployment & S&P 500 Index

The Fed

Federal Reserve raised four times.

3/16/2022

5/4/2022

6/15/2022

7/27/2022

9/21/2022

11/2/2022

12/14/2022

+.25

+.50

+.75

+.75

+.75 our view

+.25 our view

+.25 our view

+3.50 by year-end

We expect the above to be the path of the Fed for the remainder of 2022. We believe the fed will slow up in front of mid-term elections. We see unemployment approaching 6% by year-end and as high as 10% by the second quarter of 2023. This will also give the fed room for pause.

We do not think the fed will reverse course as inflation will persist. It is a no-win situation for the Fed. The real error by the Fed was believing the correlation between currency and commodities was intact; it was not. This is a supply chain issue and it will take rising unemployment; better welfare policy, and a recession to normalize main street.

The War & Policy

Raising Rates will not stop the war nor inflation. The Fed will not be able to stop supply chain issues by raising rates so they will overshoot. The war in Ukraine taught us that in the last three decades, a lot more countries have become dependent on fossil fuels, food, commerce, etc. from countries other than their own.

Putin has outsmarted Washington DC as the sanctions were a flop. The US and Europe suffered while Russia is stronger financially. The war highlighted how dependent the world is on commodities and the flow of money. The sanctions disrupted the money flow and it is a fragile system at best. Expect this to continue even post-war. Putin is going to trade gas and oil in Rubles as a challenge to the dollar; so far, he is succeeding. The U.S. Treasury’s miscalculation with sanctions allowed Putin to begin to dislodge the dollar as the reserve currency of the world and we believe this will weaken the United States. Making us dependent on foreign oil and other goods by signing executive orders to halt drilling etc. is another policy blunder. These can be expensive and not easily fixed by raising interest rates.

Border Policy – Expensive! A huge cost to this country, at a time when we can least afford it. 2,000,000 people annually at $20,000.00 per person for food, medical, and housing is $40 billion per year, every year. Over 20 years it’s $1 trillion! This doesn’t include the 2,000,000 people that will come in next year. I suspect the numbers are even higher. The cost of crime that goes with it is approximately $2 trillion annually*.

Policy in Washington D.C. has gone off the rails. Ukraine, Afghanistan, USA Oil Production, Soft on China, Mexico, etc. are disruptive to the flow of commerce and very expensive. I never thought Washington D.C. could really have an impact, I was wrong on that!

In Summary

The good news is markets have pricing power, people don’t. As a hedge to inflation, the market over time is positive but the entry point is lower from here, in our view. We continue to see high-quality floating rate paper as the best risk-reward in the fixed income sector.

Predictions By (1/1/2023)

Fed Funds 3.50%

S&P 3500

QQQ 265

30 yr. bond 2.50%

Unemployment 6.00%