Walking in The Mud

John Lekas – CEO and Senior Portfolio Manager

January 30th, 2023

2023 won’t be the beat-up of 2022, but we believe it will be like walking in mud: slow, arduous, and no easy sprints.

So Goes January, So Goes the Year.

Typically, what happens in January tends to set the stage for the rest of the year, and it has been a great January for equity markets. Credit spreads tightening, CLO and corporate market well-bid also. The earnings boogeyman is gone. The Ukraine war is contained. Balance in Washington, DC, means inflation, and the Federal Reserve should begin to cool down.

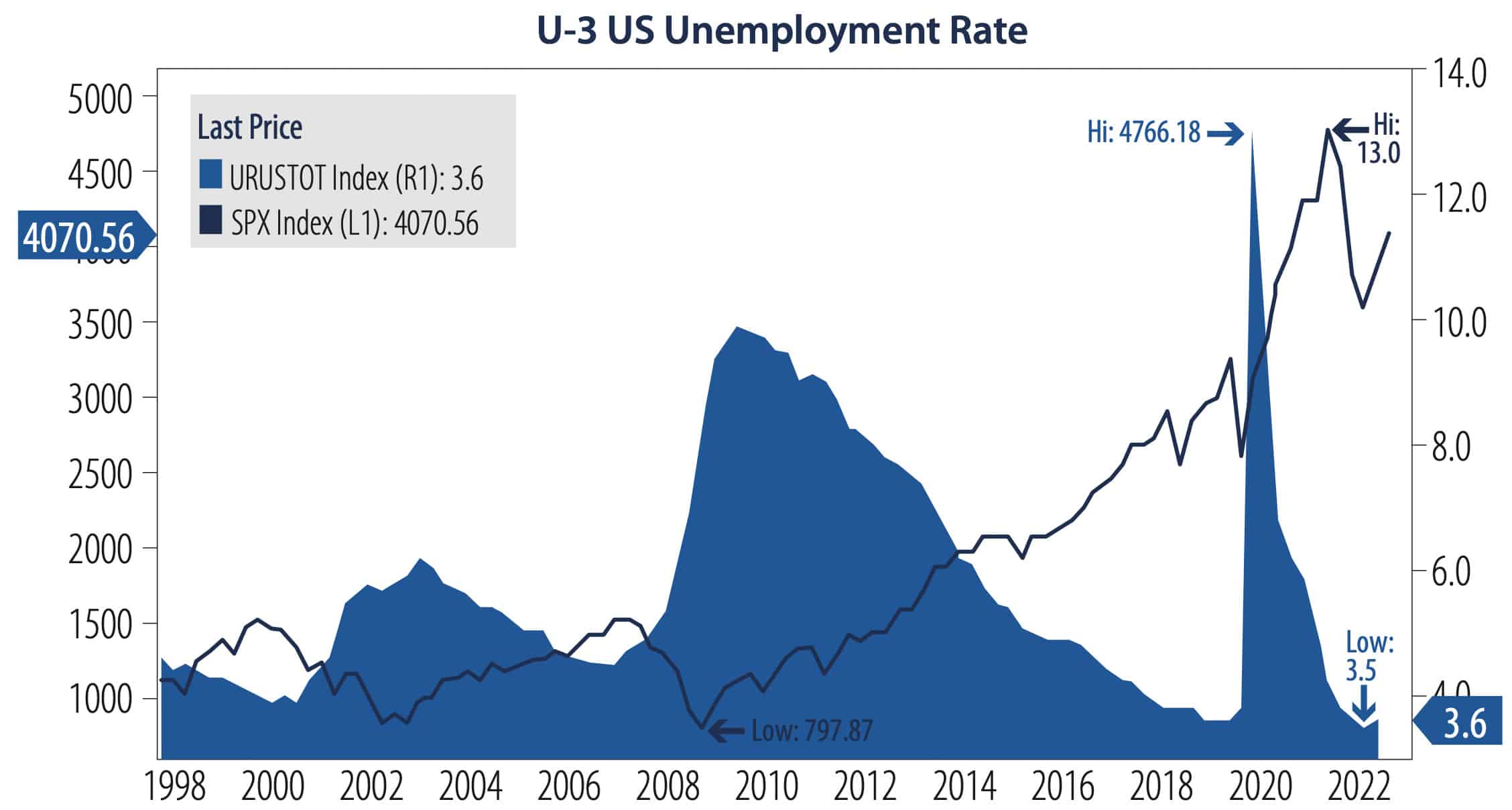

So, what’s the problem? In our opinion, it will take markets and main street another year to return to normal. We have yet to see the bankruptcies (like Bed Bath and Beyond and other peripheral operations). The commercial real estate markdown needs to happen ($175 billion or so), and supply chain problems may persist until unemployment reaches 6% (U-3), which means workers need to get a routine if they want a job (and start showing up!).

Despite these challenges, there are still opportunities for investors to find success in the markets. With the Fed increasing rates in the last 12 months, credit is now giving equity markets a run for their money, and we believe it should continue to do so for the remainder of the year. We do not believe the Fed will lower rates this year but may pause in the 5.25 – 5.50 range, making the short end of the curve the best risk-reward opportunity in 2023. The next Fed meeting is February 1. 2023, and we believe they could raise rates to 0.50 BPS rather than 0.25.

Looking Ahead

We believe 2023 will be sideways to down for major markets globally.

Written by John Lekas, CEO and Senior Portfolio Manager at Leader Capital

For more information on this topic or to learn about the Leader High-Quality Floating Rate Fund, contact us at 800.269.8810 or visit leadercapital.com.

This commentary is intended to be general in nature, reflects our opinions and is based on our best judgment at the time of writing. No warranties are given or implied regarding future market activity. This commentary is not intended to be, nor should it be used as a substitute for individualized investment advice. No specific decisions should be made based on this commentary. These opinions should not be construed as a solicitation for any service. Past performance does not guarantee future results.

Important Risks: Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher quality bonds generally offer less risk than longer term bonds and a lower rate of return. Generally, a fund’s fixed income securities will decrease in value if interest rates rise and vice versa.

Mortgage-backed investments involve risk of loss due to prepayments and, like any bond, due to default. Because the sensitivity of mortgage- related securities to changes in interest rates, a fund’s performance may be more volatile than if it did not hold these securities. Foreign Investments can be riskier than U.S. investments. Potential risks include currency risk that may result from unfavorable exchange rates, liquidity risk if decreased demand for a security makes it difficult to sell at a desired price, and risks that stem from substantially lower trading volume on foreign markets. These risks are generally greater for investments in emerging markets, which are also subject to greater price volatility, and custodial and regulatory risks.

Foreign Investments can be riskier than U.S. investments. Potential risks include currency risk that may result from unfavorable exchange rates, liquidity risk if decreased demand for a security makes it difficult to sell at a desired price, and risks that stem from substantially lower trading volume on foreign markets. These risks are generally greater for investments in emerging markets, which are also subject to greater price volatility, and custodial and regulatory risks.

This material must be preceded or accompanied by a prospectus. An investor should consider the Fund’s objectives, risks, charges and expenses carefully before investing or sending money. This and other important information can be found in the Fund’s prospectus. For more information please call 800-269-8810. Please read the prospectus carefully before investing.

Leader Capital Corp. serves as adviser to Leader High Quality Floating Rate Fund, distributed by Ceros Financial Services, Inc. Member FINRA/ SIPC. Leader Capital and Ceros are not affiliated. CMP