Don’t Fight the Fed

John Lekas CEO

September 22nd, 2023

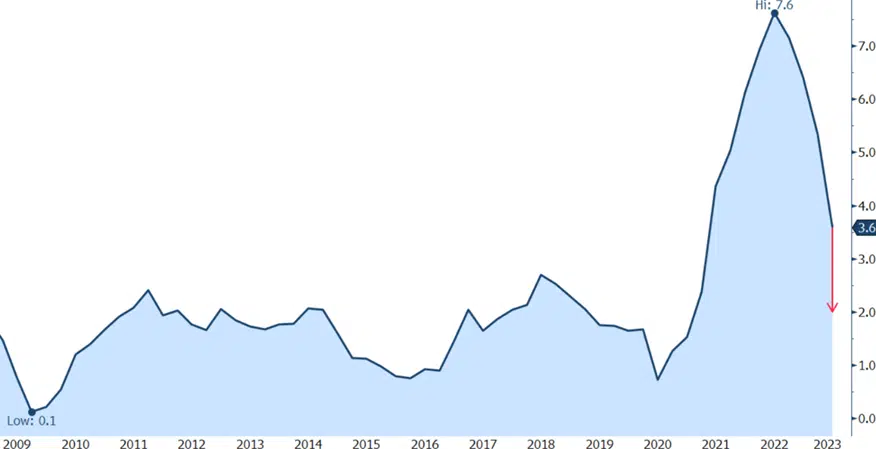

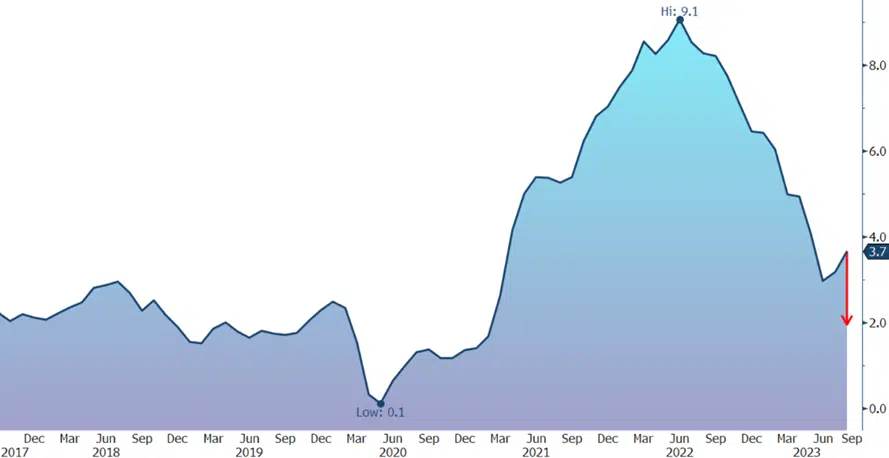

“Don’t fight the Fed.” These individuals are academics, not rational business people. The good news is they will inform you of their intentions; there’s no need to second-guess them. They have stated that they are data-dependent, so let’s examine the data! It clearly indicates that they will continue to raise rates. The two inflation components are wages and prices, and the Fed assesses this primarily through the CPI and GDP deflator, both of which suggest higher rates. It seems like we can expect two more rate hikes this year, bringing the Fed funds rate to 6%. The goal is a 2% inflation/growth rate.

GDP US Deflator

US CPI

We believe that the weak dollar will persist, leading to further price inflation in commodities such as oil, gas, steel, aluminum, food, and more. Even if the Fed were to start lowering rates (which they are not), these costs could still rise significantly if the dollar falls precipitously. Labor strikes and other factors will continue to exert upward pressure on wages, regardless of the Fed’s actions. One bright spot is unemployment, which has ticked up. If unemployment reaches 5% or 6%, wages may start to stabilize or even decline, but that’s still a ways off.

I often get asked, ‘When will you extend maturities?’ My response is that we will do so when the U-3 Unemployment rate is close to 5% or when the yield curve flattens, meaning that the long-term bond yield is close to the Fed funds rate. Until then, we will keep our duration short and maintain high credit quality. We have maintained this strategy since 2020 and believe it offers the best risk-reward profile on the yield curve. Short-duration bonds present a much more favorable risk return compared to equities at this time.

For Financial Professional Use Only – Email not for Public Distribution

Investing in any mutual fund involves risk, including loss of principal. The risks specific to the Leader Funds are listed on the attached Fact sheets and detailed in the prospectuses for the funds. There is no guarantee the funds will achieve their objectives. Expense ratios are as of the 10/1/2022 Prospectus.

An investor should consider the Fund’s objectives, risks, charges, and expenses carefully before investing or sending money. This and other important information can be found in each Fund’s prospectus. For more information, please call please read the prospectus carefully before investing.

Current Yield is the weighted average of the annual rate of return based on price. It is calculated by the coupon divided by the price. Average Yield-to-Maturity is the weighted average of the percentage rate of return if the security is held to maturity.

Leader Capital Corp. serves as adviser to Leader Short Term High Yield Bond Fund, and Leader High Quality Floating Rate Fund, distributed by Vigilant Distributions, Inc., Member FINRA/SIPC. Leader Capital and Vigilant are not affiliated.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Share prices and investment returns fluctuate and investor shares may be worth more or less than the original cost upon redemption. To obtain performance as of the most recent month-end, please call