Treasury Yields Hit 4%, 5%, and 6%

John Lekas – CEO & Senior Portfolio Manager, Leader Capital

May 12th, 2025

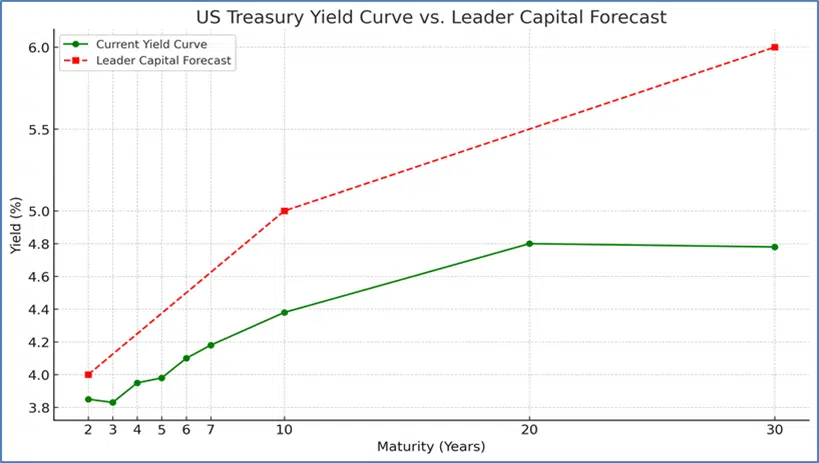

We believe U.S. Treasury yields are poised to rise meaningfully by year-end. Barring a major shift in global conditions, we see the 2-year reaching 4%, the 10-year nearing 5%, and the 30-year approaching 6%—up from current levels of 3.97%, 4.45%, and 4.87% (as of 5/12/25). This outlook includes a significantly steeper yield curve, with a 200-basis point spread between the 2-year and 30-year.

Our “4-5-6” view is driven by sticky inflation, persistent wages, and housing pressures. A weaker dollar and tariff uncertainty may further fuel inflation and erode economic growth, especially with rising import costs.

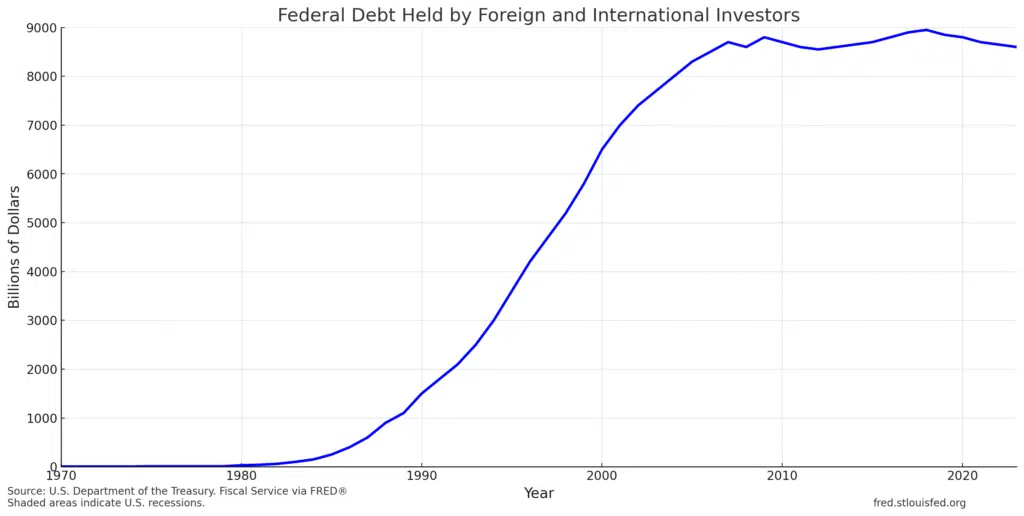

Foreign holders own $8.5 trillion in U.S. Treasuries, and reduced buying interest could push yields higher. Global investors may be reevaluating the perceived safety of U.S. debt, demanding greater compensation for longer maturities.

Risk and Positioning

Volatility, duration, and liquidity risks remain elevated. In this environment, long-duration bonds offer poor risk/reward. We believe investors are better served in shorter-duration securities.

This document contains preliminary information only, unless otherwise noted, and is subject to change at any time and is not and should not be assumed to be complete or to constitute all the information necessary to adequately make an investment decision. Investing in any mutual fund involves risk, including loss of principal. There is no guarantee the funds will help achieve their objectives. Expense ratios are as of the 9/28/2024 Prospectus. An investor should consider the Fund’s objectives, risks, charges, and expenses carefully before investing or sending money. This and other important information can be found in each Fund’s prospectus. For more information, please call 1-800-269-8810. Please read the prospectus carefully before investing. Current Yield is the weighted average of the annual rate of return based on price. It is calculated by the coupon divided by the price. Average Yield-to-Maturity is the weighted average of the percentage rate of return if the security is held to maturity. Leader Capital Corp. serves as adviser to Leader Short Term High Yield Bond Fund, and Leader High Quality Income Fund, distributed by Vigilant Distributions, Inc., Member FINRA/SIPC. Leader Capital and Vigilant are not affiliated. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Share prices and investment returns fluctuate and investor shares may be worth more or less than the original cost upon redemption. To obtain performance as of the most recent month-end, please call 1-800-269-8810