“All’s Well That Ends Well”

John Lekas – CEO & Senior Portfolio Manager

April 23, 2025

Credit markets and global interest rates remain relatively firm, reflecting a cautious but stable risk environment. We believe volatility will continue in equity and fixed income markets, but the fundamentals remain intact. Per the chart below, spreads have widened over the past month but are well within historic averages:

High-yield credit (HYG): The current spread is 431.03 basis points, with a low of 314.10 and a high of 528.62 (1yr).

Investment-grade credit (LQD): The current spread is 173.66 basis points, with a low of 141.84 and a high of 205.82 (1yr).

Credit Spreads*

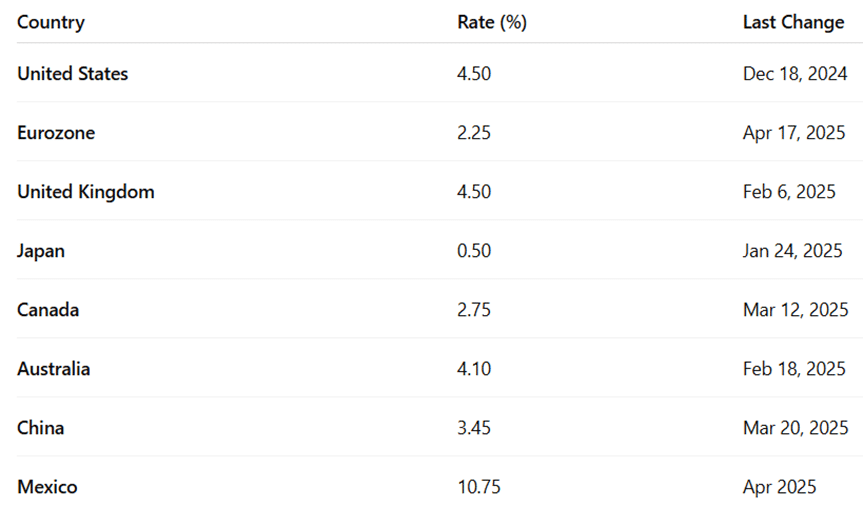

Global Overnight Interest Rates (as of April 2025)

Since last November, we’ve been saying that the Trump Administration is promoting a weak dollar policy to help exports and a more competitive posture. That’s playing out. This points more toward inflation rather than recession.

The weak dollar will move treasury yields higher, particularly from foreign investors who will demand higher rates due to a lower dollar. While recent volatility has rattled markets, the economic backdrop remains intact.

*Source: Bloomberg. The views and statements expressed herein are those solely of Leader.

Additional interest rate data sourced from: Trading Economics, “Central Bank Interest Rates.” TradingEconomics.com, April 2025. https://tradingeconomics.com/country-list/interest-rate

This document contains preliminary information only, unless otherwise noted, and is subject to change at any time and is not and should not be assumed to be complete or to constitute all the information necessary to adequately make an investment decision. Investing in any mutual fund involves risk, including loss of principal. There is no guarantee the funds will achieve their objectives. Expense ratios are as of the 9/28/2023 Prospectus. An investor should consider the Fund’s objectives, risks, charges, and expenses carefully before investing or sending money. This and other important information can be found in each Fund’s prospectus. For more information, please call 1-800-269-8810. please read the prospectus carefully before investing. Current Yield is the weighted average of the annual rate of return based on price. It is calculated by the coupon divided by the price. Average Yield-to-Maturity is the weighted average of the percentage rate of return if the security is held to maturity. Leader Capital Corp. serves as adviser to Leader Short Term High Yield Bond Fund, and Leader High Quality Income Fund, distributed by Vigilant Distributions, Inc., Member FINRA/SIPC. Leader Capital and Vigilant are not affiliated. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Share prices and investment returns fluctuate and investor shares may be worth more or less than the original cost upon redemption. To obtain performance as of the most recent month-end, please call 1-800-269-8810