Nowhere to Hide

John Lekas – CEO & Senior Portfolio Manager

November 13th, 2025

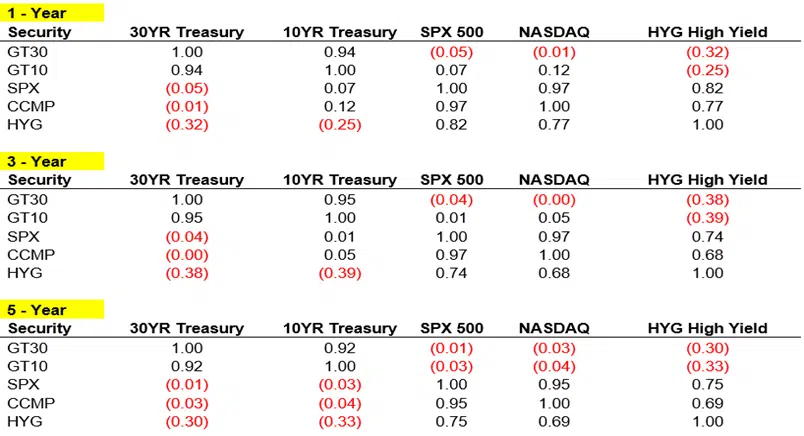

The traditional negative correlation between Treasuries and risk assets has broken down. Historically, when equities sold off, investors moved into Treasuries as a safe haven, creating a dependable inverse relationship. That dynamic has weakened considerably over the past five years and especially in the last year. As shown in the correlation chart, the 30-year Treasury and the S&P 500 have shown correlations of –0.05 over the past year, –0.04 over the past three years, and –0.01 over the past five years—indicating virtually no meaningful relationship at all.

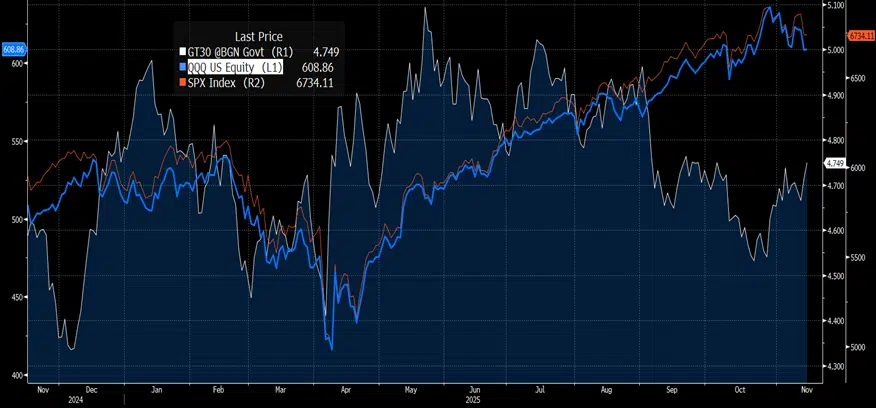

When the Trump Administration announced new tariffs on April 2, 2025, the S&P 500 fell 12.14% between April 2 and 8, while the 30-year Treasury yield briefly dipped from 4.50% to 4.41% before climbing to 4.76%. This highlights how Treasuries have failed to provide their traditional hedge during periods of market stress. Whether driven by persistent inflation, unreliable economic data, or uncertainty surrounding fiscal and monetary policy, Treasuries and equities have increasingly moved in tandem rather than offsetting each other. As a result, investors are finding there is effectively nowhere to hide across traditional asset classes

Correlations Chart

The following tables show 1-year, 3-year, and 5-year correlations among U.S. Treasuries, equity indices, and high-yield market. Values close to +1.00 indicate strong positive correlation (moving together), while negative values (in parentheses) indicate inverse relationships. Source: Bloomberg

U.S. 30-Year Treasury Vs. SPX Index/NASDAQ

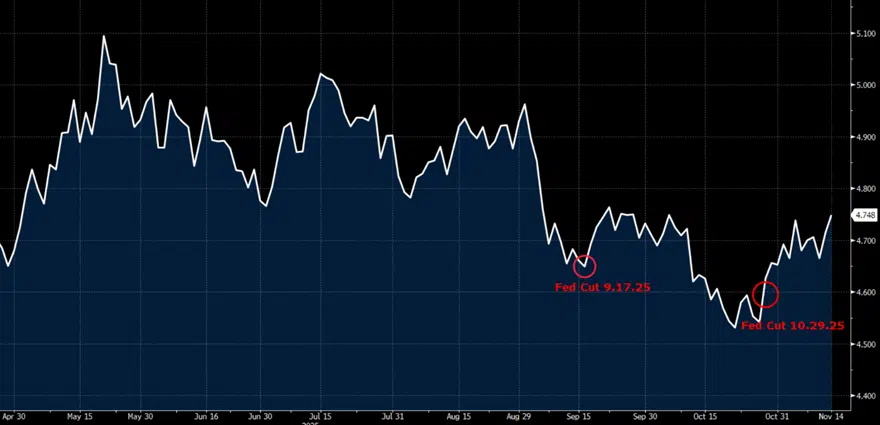

In this environment, we see the short end of the yield curve as the most attractive risk-reward opportunity in fixed income for the remainder of 2025. We do not expect the Federal Reserve to cut rates at its December 10th meeting. The Fed has already cut rates twice in 2025, and each time the 30-year yield moved higher—because, as we’ve noted, the Fed should not be cutting rates in an inflationary environment.

U.S. 30-Year Treasury and Fed Cuts in 2025

Summary

- The historic inverse correlation between Treasuries and equities has broken down.

- We do not expect a Fed rate cut at the December 10th Fed meeting.

- The short end of the yield curve presents the most favorable risk-reward outlook for the remainder of 2025 in fixed income.

Source: Bloomberg. The views and statements expressed herein are those solely of Leader. This commentary is for informational purposes only and does not constitute investment advice. This document contains preliminary information only, unless otherwise noted, and is subject to change at any time and is not and should not be assumed to be complete or to constitute all the information necessary to adequately make an investment decision. Investing in any mutual fund involves risk, including loss of principal. There is no guarantee the funds will achieve their objectives. Expense ratios are as of the 11/28/2024 Prospectus. An investor should consider the Fund’s objectives, risks, charges, and expenses carefully before investing or sending money. This and other important information can be found in each Fund’s prospectus. For more information, please call please read the prospectus carefully before investing. Current Yield is the weighted average of the annual rate of return based on price. It is calculated by the coupon divided by the price. Average Yield-to-Maturity is the weighted average of the percentage rate of return if the security is held to maturity. Leader Capital Corp. serves as adviser to Leader Short Term High Yield Bond Fund, and Leader High Quality Income Fund are distributed by Matrix 360 Distributors, LLC, Member FINRA/SIPC. Leader Capital and Matrix 360 are not affiliated. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Share prices and investment returns fluctuate and investor shares may be worth more or less than the original cost upon redemption. To obtain performance as of the most recent month-end, please call 1-800-269-8810